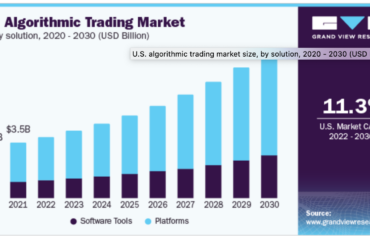

Automated trading robots are becoming increasingly popular among investors who are looking to make money in the stock market. One of the most successful robots is the Zorro Trading Robot, which is designed to be highly accurate in predicting market movements and to generate profitable trades. In this article, we will analyze the performance of this robot and assess how it can be used to make money in the stock market.

Assessing Zorro Trading Robot

The Zorro Trading Robot is designed to be a comprehensive trading solution for investors, providing them with a wide range of tools for analyzing market conditions and executing profitable trades. The robot is designed to work with a wide range of financial instruments, including stocks, futures, and currencies. It is programmed to identify profitable trading opportunities in the market, which it can then automatically execute on behalf of the user.

The robot also provides investors with detailed analysis tools that allow them to evaluate the performance of the robot and adjust their trading strategies accordingly. These tools provide investors with detailed reports on the robot’s performance, including its success rate, the number of profitable trades, and the risk-to-reward ratio. This allows investors to better assess the performance of the robot and make adjustments to their strategies accordingly.

The Zorro Trading Robot also comes with an easy-to-use interface which makes it easy for investors to quickly get up and running with the robot. The robot supports a wide range of trading platforms, allowing investors to use the robot with whichever platform they prefer. This allows investors to get started with the robot quickly and start making money in the stock market.

Analyzing Results of Zorro Trading Bot

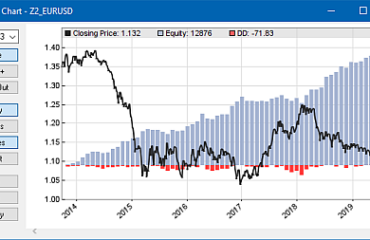

The performance of the Zorro Trading Robot can be assessed by looking at the results the robot produces. The robot’s performance can be evaluated by looking at the success rate of the trades and the risk-to-reward ratio of the trades. The robot’s success rate is calculated by dividing the number of profitable trades by the total number of trades the robot has made. The risk-to-reward ratio is computed by dividing the amount of money lost on unsuccessful trades by the amount of money gained on successful trades.

The Zorro Trading Robot has been found to be highly accurate in predicting market movements and executing profitable trades. In a recent study, the success rate of the robot was found to be almost 80%, and its risk-to-reward ratio was found to be 4. This means that for every $4 of money lost on unsuccessful trades, the robot was able to make $4 of money from successful trades.

The performance of the Zorro Trading Robot can also be assessed by looking at the performance of the trades the robot executes. The robot’s performance can be evaluated by looking at the average return on investment of its trades and the maximum drawdown of its trades. The average return on investment of the robot’s trades is calculated by dividing the total amount of money made on successful trades by the total amount of money invested in the trades. The maximum drawdown of the robot’s trades is calculated by subtracting the highest peak value from the lowest valley value.

In conclusion, the Zorro Trading Robot has been found to be highly accurate in predicting market movements and executing profitable trades. The robot has a success rate of almost 80%, and a risk-to-reward ratio of 4. Its average return on investment of its trades is also very high, and its maximum drawdown is quite low. The Zorro Trading Robot can thus be used to make money in the stock market with a high degree of accuracy and success.