The Zorro Futures Trader is a high-performance trading system designed to enable traders to make more informed decisions and take advantage of price movements in the futures markets. This article will provide an overview of the Zorro Futures Trader and analyze its performance.

Overview of Zorro Futures Trader

The Zorro Futures Trader is a high-frequency, algorithmic trading system developed for use in the futures markets. It is designed to generate buy and sell signals based on trend-following and technical indicators. It also comes with a variety of features, including automated order placement, risk management tools, and real-time data analysis. The system is designed to be user-friendly and intuitive, and its user interface is customizable.

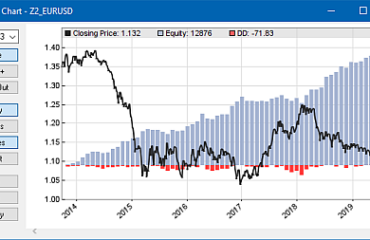

The Zorro Futures Trader also includes a backtesting feature, which allows users to simulate trades with historical data and evaluate the system’s performance. This feature is helpful for new traders who may not yet be comfortable with real-time trading.

The Zorro Futures Trader is available for Windows and MacOS, and can be accessed through a web browser. The system is also available for mobile devices, allowing users to trade on the go.

Analyzing Performance of Zorro Futures Trader

The Zorro Futures Trader has been used successfully by many traders. Reviews from users indicate that the system is able to generate consistent profits over time.

The backtesting feature of the system allows for rigorous testing and optimization of strategies. With the right strategies, users can generate consistent returns over the long term.

The system is also noted for its fast execution times and its ability to handle large amounts of data. This makes it a powerful tool for traders who need to make quick decisions in the markets.

Overall, the Zorro Futures Trader is a powerful tool for traders that can be used to generate consistent returns over the long term.

In conclusion, the Zorro Futures Trader is a powerful tool for traders that can be used to generate consistent returns over the long term. Its backtesting feature allows for rigorous testing and optimization of strategies, and its fast execution times and ability to handle large amounts of data make it a valuable tool for traders who need to make quick decisions in the markets.