Zorro Trading Bar Period is a popular trading strategy used by many experienced traders. It is based on the idea of analysing the market over specific periods of time to help traders make informed decisions. In this article, we examine the Zorro Trading Bar Period and its advantages and disadvantages.

Zorro Trading Bar Period: Overview

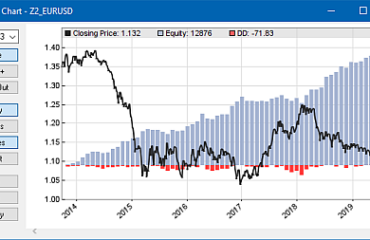

The Zorro Trading Bar Period is a technical analysis strategy used by traders to identify trends in the market. The strategy uses bar charts to illustrate the price action of a stock or other asset over a certain period of time. The bars are divided into various categories, such as opening, high, low, and closing prices. Traders can then compare the closing prices of each bar to the opening prices to identify any trends. This strategy is used to identify potential entry and exit points for trading.

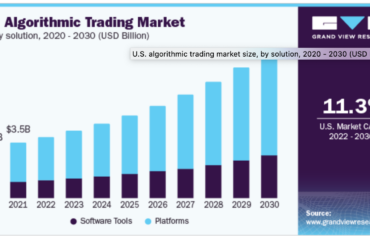

The Zorro Trading Bar Period can be used in any asset class, such as stocks, options, futures, and forex. It is also used in various trading styles, including swing trading, day trading, and position trading. The period of time used for the bars can range from one minute to one month, depending on the trader’s needs. The strategy can also be used with various indicators, such as moving averages, RSI, and MACD, to help traders identify potential trades.

Analyzing Zorro Trading Bar Period

The Zorro Trading Bar Period is a powerful trading strategy that can be used to identify trends in the market. The strategy is simple and straightforward, and it can be used by both experienced and novice traders. It can also be used in any asset class and with any trading style.

However, the strategy does have some drawbacks. For instance, the accuracy of the strategy improves as more bars are used, which means that traders need to have access to a longer period of data to make the most out of the strategy. Additionally, different traders may interpret the same data differently due to their experience levels and trading styles. This means that it is important for traders to be comfortable with their analysis before committing to any trades.

Finally, the Zorro Trading Bar Period is only one tool that traders can use to identify trends in the market. It is important for traders to also use other strategies, such as risk management and fundamental analysis, to make informed decisions.

In conclusion, the Zorro Trading Bar Period is a popular and powerful trading strategy. It can be used by any trader in any asset class and trading style. However, it is important for traders to understand that the strategy has some limitations, such as the need for more data to improve accuracy and the potential for different traders to interpret the same data differently. Finally, it is important for traders to use other strategies to make informed decisions.